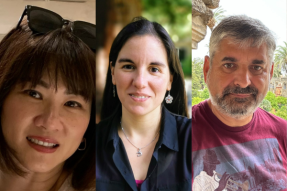

The following is an interview with Kiva Investment Manager Kendra Thorogood, who manages a portfolio in Eastern Europe and Central/Southeast Asia. Some of the responses have been edited for clarity and brevity.

Tell us a little bit about yourself and how you ended up in your current role at Kiva.

I’m currently a Kiva Senior Investment Manager for Eastern Europe and Central Asia and have been with Kiva for around five and a half years now. I’m originally from Canada and studied finance at university. I knew that I wanted to do something more with my degree than working within the traditional finance sector, so I spent 3 months in Bangladesh with the Grameen Bank while I was still in school. That was my first introduction into microfinance.

Once I graduated university, I traveled to Tajikistan to work in a microfinance program and have occupied various roles in the microfinance and financial inclusion industry ever since. I finally ended up at Kiva and am now responsible for managing all of Kiva’s partnerships or investments in Eastern Europe and Central Asia from my home base in Bangkok. I also manage a few partners in Thailand and Cambodia too.

Since you’re based internationally, we imagine that there are many different perspectives that you can offer the Kiva community. To get started, what is your daily life in Thailand like, and how have things changed since COVID-19 and quarantine started?

I work out of a coworking space with two other investment managers in Bangkok. When Kiva issued its mandatory policy of working from home, we immediately followed protocol. Many of us were in the midst of deciding whether we should stay in Thailand or go back to our home countries. I chose to stay here because my life is here, and I didn’t want to expose any of my family members to the virus after flying. It made a lot more sense to stay.

Thailand is also doing very well in terms of managing the virus. Residents were wearing masks even before COVID-19 struck. There’s kind of a different idea of mask-wearing here. People in Thailand typically wear masks to protect themselves from pollution or protect others from their own sickness, so they didn’t have to adapt. I think that’s why Thailand has only had around 3,200 confirmed cases and 58 deaths out of a population of 70 million.

There are also many other measures in place. For instance, any time you enter a 7-Eleven, a supermarket, or even a condo building, they do temperature checks. You’re required to wear masks to enter any of these places, and there’s even hand sanitizer in the elevators. In certain cases, you can get fined for not wearing a mask in a public space. I was able to self-isolate for two months, but that isn’t possible for many people here. There are a lot more people in Thailand that are considered “essential workers” and are living paycheck to paycheck due to the terrible income disparity. When I ventured back out of isolation, I didn’t find that there was that much of a change in the streets. There were tons of people everywhere, and it still felt like it was pretty busy.

How soon might the local economy pick back up?

We’re actually in Phase 5 of reopening already. The first phase started on May 3rd. They opened restaurants, parks and a few other businesses with certain restrictions in place. Phase 2 began on May 17, when they started opening up shopping malls. At these shopping malls, people are tracked through a check-in, check-out system so that if a case is found, officials can track where that person has been. Phase 5 just started on July 1. While there are strict measures in place, there is a whole list of things they’re reopening now.

The only new cases that have been found recently are from Thai citizens who have come back to the country on repatriation flights and are in government quarantine. We’re doing really well in terms of new cases, and the economy is picking back up. I’m noticing more traffic now, and some people are going back to work. There is a lot of hope for Thailand’s economic status, but it is still a country that is very dependent on tourism, and we don’t know when that industry will start back up again.

With all of the shutdowns and economic downturns caused by COVID, how are the Field Partners and borrowers in the portfolio you manage doing?

I work with Field Partners located in 12 different countries, and it varies heavily on the location. Certain countries like Albania shut down pretty early due to their heavy interaction with Italy. Now, they are reopening. There are also places like Tajikistan, where they only officially found their first official case on April 30. That’s when they started shutting everything down. Before that moment, Tajikistan had declared a pneumonia pandemic. There are, of course, political factors at play in this situation. As a result, the curve in Tajikistan has skyrocketed since they found their first case. Pneumonia pandemics have also been declared in other Central Asian countries like Kyrgyzstan.

These countries have very limited amounts of working ventilators and the medical systems are extremely under-resourced, so I’m most worried about them at this stage.

There’s obviously a huge spectrum in terms of the action that different countries have been taking and, as a result, our Field Partners and borrowers have been affected differently in each case. Many Field Partners are offering borrowers relief by temporarily postponing loan repayments. In turn, this affects financial institutions and their ability to pay for operating expenses. Within certain locations, the governments and central banks took action by implementing certain policies to assist financial institutions and make sure they stay afloat, while in other cases, support has not been available and Field Partners have needed to find some way to sustain themselves.

Some institutions that I work with have been able to maintain their operations as normal, while others have had to rely on some sort of relief of their financing. Luckily our Kiva lenders automatically provide that relief because if partners aren’t receiving repayments from borrowers, they don’t repay lenders. Other funders don’t operate in the same capacity. Kiva is uniquely positioned to help in this time, and that’s why I’m proud that I work for an organization that has such a capacity built into its model.

Something interesting that I’ve found in talking to my partners is that many of them are becoming more focused on the agriculture industry. Within my region, a great deal of borrowers who are farmers haven’t been hit by the pandemic too badly. What they are producing is still considered essential during this time. As borders have shut down, many countries I work with have been unable to import the food products they typically rely on. Central Asia has very close trade ties with China. Now that the borders are shut down, these countries are very dependent on local producers and local farmers. That has been an interesting shift to see.

For instance, Bai Tushum Bank in Kyrgyzstan has contacted me and said that they need to post a lot of loans to farmers. I’m so happy that our platform is now in a state where it can handle this issue without a bunch of loan expirations. Credo in Georgia is another big bank that has a total portfolio of $300 million and has also pivoted to focus on agriculture. They have received external funding to support local farmers and the local agriculture industry due to the high demand for their products.

Lenders and volunteers are eager to hear more information from the field during this crisis. How long has it taken you to get a handle on what's going on in your portfolio, or do you feel like your understanding is ever-evolving?

I still don’t feel like I have a handle on where each country stands, because the situation is changing so quickly. Some countries are shutting down again and are experiencing second waves of the virus. There’s still not a visible end in sight. It’s also difficult to keep track of all of the Field Partners. Some partners are reaching out to me and offering up this information, and others are a bit more difficult to contact. It really depends on the partner.

For me, since I’ve been in this position for five and a half years and have met the staff members at my partners many times in person on site, I have really great relationships with them. I don’t have any partners that are completely unresponsive. It can just be difficult to get a hold of them when they are working from home. A lot of partner employees have internal VPNs set up where they can’t access any of their work outside of their home, or the staff members don’t have laptops and are unable to frequently check their emails. That is why it’s sometimes difficult to get a hold of them, and why loan posting has reduced as well.

What is Kiva doing to address the issues faced by COVID-impacted partners?

In general, partners are limiting the loans that they provide right now because those loans can be pretty risky. You can’t predict a second wave of infection, and you don’t know if businesses will start to shut down again. For example, our partner in Georgia has been wary of providing loans to businesses they believe may be shut down during a second wave of COVID-19. I’ve tried to turn this perspective around by talking to this partner about the businesses they work with that will need an injection of cash in order to restart after being shut down for so long. We want to know how we can support these types of businesses.

I’ve also been talking to a couple of partners about specific recovery loan products that we could fund and that they could then provide to their clients. I haven’t launched anything yet, but I do have one Crisis Support Loan (CSL) in Cambodia right now. A Field Partner there has been noticing that a lot of their clients really need cash to buy basic necessities like food to feed their families, so they have been providing small social emergency loans for this purpose. They want to keep the cost of those loans as low as possible. Instead of getting this Field Partner to post each individual loan to our site (each individual loan is only $200 dollars and the relative operating expense associated with posting a $200 loan to Kiva can be pretty high, especially if you are posting many at once), we raised a $200,000 for them to disperse among their clients.

That’s how we have been thinking about the Crisis Support Loan product in general: it’s a way to not only support Field Partners directly but to also support their borrowers.

What brings you a sense of hope during this difficult time?

I know a lot of people are still in isolation and don’t feel like things are going to open up any time soon. Isolation is very lonely, and I experienced that loneliness when I was living by myself for months. However, when things started opening up again in Thailand on May 3, I realized that there is an end to this. Something that was initially affecting me a lot was the uncertainty around this pandemic’s end date. It’s nice to have a reminder that, slowly but surely, there will be an end to this.

A lot of my news I consume is about the US experience, and that’s something I’ve been grappling with as well. When I decided to break isolation, it was difficult for me to separate what was actually happening in Thailand versus the international suffering broadcast on the news.

In terms of work, I’m truly amazed by the staff members at our Field Partners and how they are stepping up at this time. I think that those working for our Field Partners are often overlooked. We tend to focus on the end client and forget that the Field Partner employees have very similar mindsets to those people that work within Kiva headquarters. We are all so passionate about the work that we do to serve our Field Partner and borrowers, but those individuals working within Field Partner are often underpaid and are dealing with really tough situations on the ground level. Knowing that we have such passionate, dedicated people working to service us and their clients every day gives me hope.

Beyond Kiva, we have this entire army of people, a Kiva ecosystem that is a lot bigger than you would imagine it to be. I think that’s something important for volunteers to remember as well. These loan officers normally work with 200+ clients and have interesting perspectives to share. They are also the ones collecting the content for the Kiva stories, taking photos of borrowers, doing interviews, etc. They know their clients’ lives inside and out, and they express their dedication to Kiva on a daily basis. Just keep in mind that these people are in really tough situations and that they don’t have the option to work from home. They’re essential workers too, and they need to get the money to the people who need it the most.

Stay tuned for more interviews with Kiva's investment managers during the pandemic.

Eager to make a difference? Head to kiva.org/covidresponse to find out how.

PREVIOUS ARTICLE

Join Kiva and Black Girls Code for a special event! →NEXT ARTICLE

Lebanon in crisis: How you can help — and how Kiva is responding →